It outlines guidelines that apply to both lenders and consumers for handling disputes about errors on billing statements. Explain the characteristics of bill of exchange Study Resources.

Bills Of Exchange Act 1949 Act 204 Bills Of Sale Act 1950 Act 268 Marsden Professional Law Book

Action includes counter claim and set off.

. STAMP ACT 1949 An Act relating to stamp duties. A bank has no right to make payment on a forged or unauthorised signature on a cheque under s 24 of the Bills of Exchange Act 1949 BEA 1949. Constituted the eighth par.

2 Interpretation of terms. Bills of Exchange Act may refer to. 23 1913 as amended.

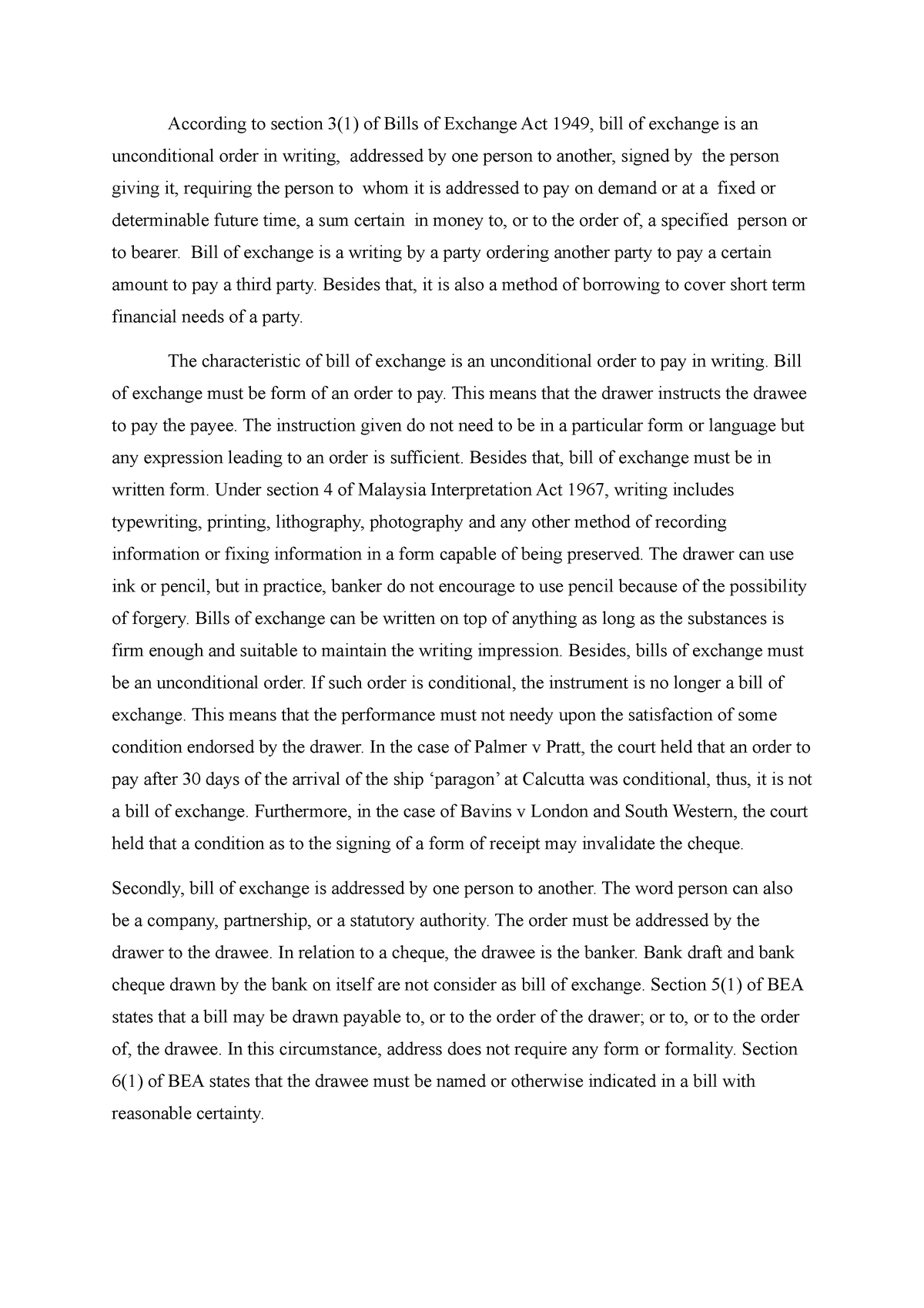

View Explain the characteristics of bill of exchange with reference to the Bill of Exchange Act 1949docx from LAW 416 at Universiti Teknologi Mara. For one of the most powerful investors on the planet the abrupt transformation might be a letdown but it is in some ways a relief. Bills of Exchange Act 1882.

Bills means a bill of exchange as defined in the Bills of Exchange Act 1909 Cth but does not include a cheque. 8 Sections seven eight and nine and all words in section ten from and including the words On any day on which it is lawful. Up to 24 cash back Bill of exchange act 1949 Federal Healthcare Resilience Task Force Alternate Care ACS Toolkit.

Explain the circumstances in which individuals are the holder in due course under section 29 of the Bills of Exchange Act 1949. 0 Ratings 0 Want to read. Bills of Exchange Act 1949.

Action includes counter-claim and set-off. In 1932 47 Stat. A bill of exchange a short-term negotiable instrument is a signed unconditional written order binding one party to pay a fixed sum of money to another party on demand or at a predetermined dateA bill of exchange is sometimes called draft or draught but draft usually applies to domestic transactions onlyThe term bill of exchange may also be applied broadly to other instruments.

A few tips to remember while drafting a case study in business law. Of section 13 of act Dec. It must be an unconditional order in writing.

In this Act unless the context otherwise requires. The order must be without any conditions or qualifies and made in writing. An Act relating to bills of exchange cheques and promissory notes.

2 This Act shall apply throughout Malaysia. Bills of Exchange Act 1908 This page was last edited on 30 April 2021 at 1617 UTC. In Marfani Co Ltd v Midland Bank Ltd 3 Diplock LJ observed that.

By virtue of section 47 of the Bills of Exchange Act 1949 BOE 1949 a bill is dishonoured by non-payment-. Bearer means the person in. B when presentment is excused and the bill is overdue and unpaid.

Read the case thoroughly and understand the critical facts and issues. Any other bill is a foreign bill. In this Act unless the context.

In this Act unless the context otherwise requires. 1 The bank is liable for conversion a strict liability tort notwithstanding that the forgery may be a perfect one. More important it could be an.

Bills of Exchange Act 1949 Act 204 Bills of Sale Act 1950 Act 268. A few tips to remember while drafting a case study in business law. Third Edition The Fair Credit Billing Act of 1974 is a federal law designed to prevent unfair credit-billing practices.

B 4411989 PART I PRELIMINARY Short title and application 1. Banker includes a body of persons whether incorporated or not. Sabah and Sarawak 1 October 1989 PU.

A both drawn and payable within Malaysia. Section is based on the tenth par. It must be in form of order and not request.

Of section 13 in 1916 39 Stat. Explain the circumstances in which individuals are the holder in due course under section 29 of the Bills of Exchange Act 1949. Acceptance means an acceptance completed by delivery or notification.

Up to 24 cash back Sec. Read the case thoroughly and understand the critical facts and issues. Support your answer with a decided case.

This Act may be cited as the Bills of Exchange Act 1882. 753 became the ninth par. Up to 24 cash back Bill of exchange act 1949 pdf Come Monday morning Bill Gross business card will read Portfolio Manager not Chairman Chief Executive President or boss of anything.

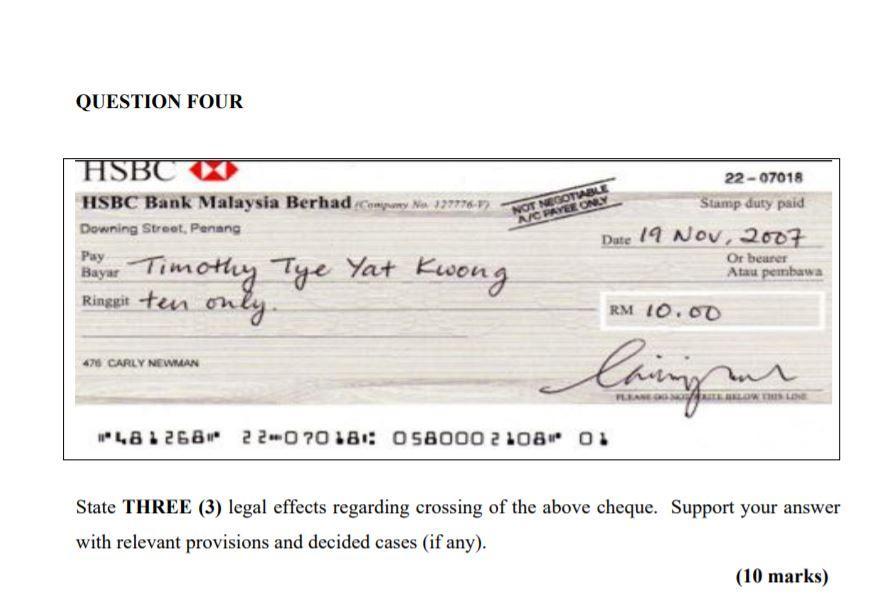

A when it is duly presented for payment and payment is refused or cannot be obtained. Donate this book to the Internet Archive library. 731 of the Bills of Exchange Act 1949 A cheque is a bill of exchange drawn on a banker payable on demand.

A bank has no right to make payment on a forged or unauthorised signature on a cheque under s 24 of the Bills of Exchange Act 1949 BEA 19491 The bank is liable for conversion a strict. 1 An inland bill is a bill which is or on the face of it purports to be. Support your answer with a decided case.

Acceptance means an acceptance completed by delivery or notification. A bill of exchange is an unconditional order in writing addressed by one person to another signed by the person giving it requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time a sum certain in money to or to the. Definitions 2 In this Act.

B drawn within Malaysia upon some person resident therein. Current version as at 24 Jul 2022. This Act is the Bills of Exchange Act 1949.

2 Unless the contrary appears on the face of the bill the holder may treat it as an inland bill. Elements of a valid cheque. 1 This Act may be cited as the Stamp Act 1949.

1478 and became the tenth par. Acceptance means an acceptance completed by delivery or notification. Text is available under the Creative Commons Attribution-ShareAlike License 30.

Peninsular Malaysia 5 December 1949. Subject to the above section 47 2 of the BOE 1949 states that. As at 10th January 2003 by Malaysia.

ACT 204 BILLS OF EXCHANGE ACT 1949 Click here to see Annotated Statutes of this Act Part I PRELIMINARY SECTION 1Short title 2Interpretation Part II BILLS OF EXCHANGE Chapter Form and Interpretation SECTION 3Bill of exchange defined 4Inland and foreign bills 5Effect where different parties to bill are the same person 6Address to drawee 7. For further details see Codification notes under sections 342 to 344 of this title. Bank means a bank or an authorized foreign bank within the meaning of section 2 of the Bank Act.

In 1923 42 Stat. Authority means the Monetary Authority of Singapore established under the Monetary.

Evolution In The Law Of Transport Noise In England Sciencedirect

Commercial Law Assignment According To Section 3 1 Of Bills Of Exchange Act 1949 Bill Of Studocu

Bill Of Exchange Act Malaysia Lucarkc

Banking Law Anusha M Virupannavar Assistant Professor Kle

Banker Customer Banker And Customer Banking Accepting For

Bill Of Exchange Act Malaysia Lucarkc

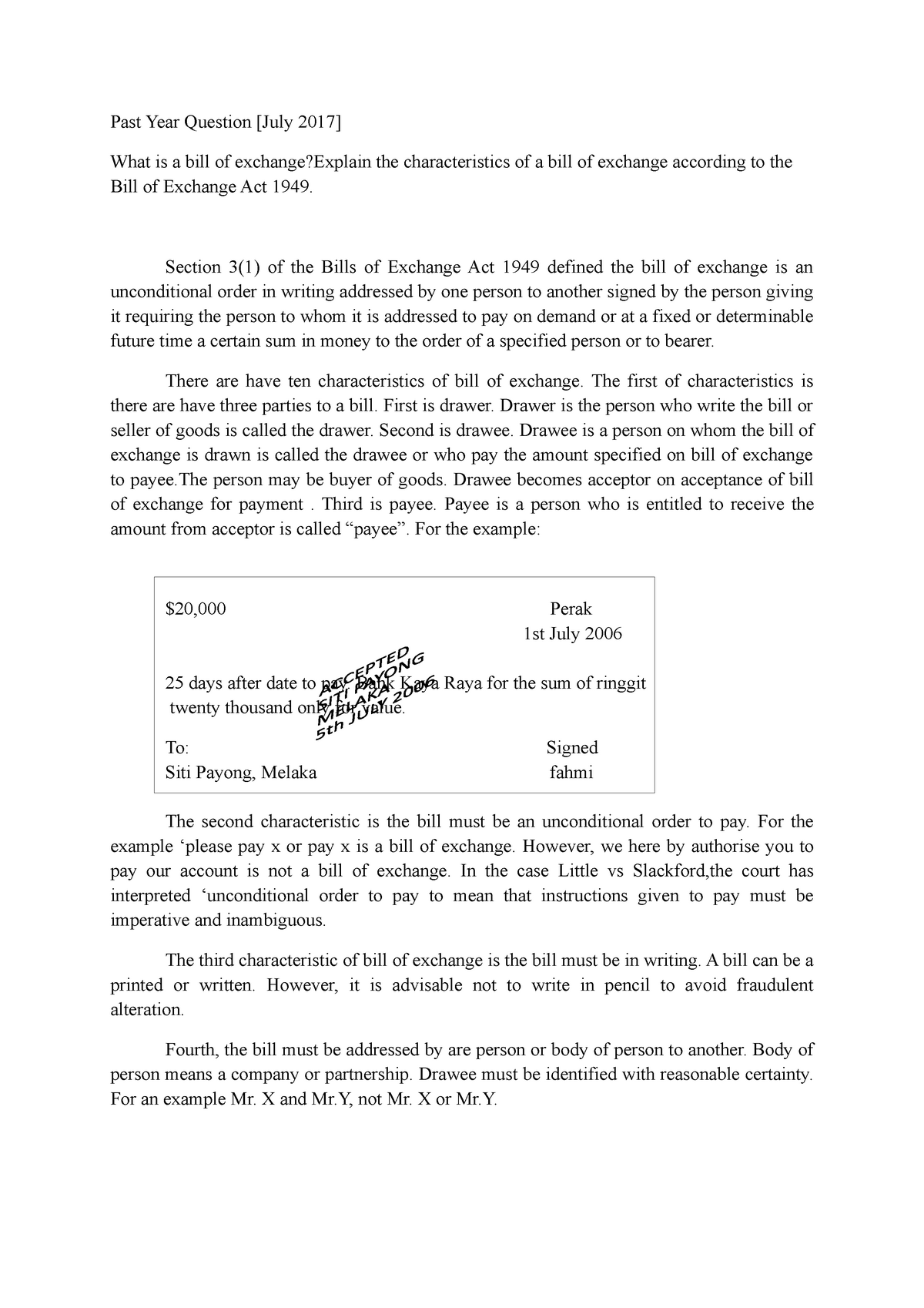

Assg Law Complete Past Year Question What Is A Bill Of Exchange Explain The Characteristics Of Studocu

Bill Of Exchange Act Malaysia Lucarkc

Analyze The Above Situation And State The Issue Chegg Com

Legal And Regulatory Aspects Ppt Download

Module 1 Bank The Word Bank Is Derived

Bill Of Exchange Act Malaysia Lucarkc

Presentation On Banker And Customer Ppt Download

Bank Banker Banking Dr Manish Dadhich Bank The

Commercial Law Assignment According To Section 3 1 Of Bills Of Exchange Act 1949 Bill Of Studocu

Chp 4 Negotiable Instrument Negotiable Instrument Is A Monetary Instrument Facilitate Trade And Studocu